Washington, D.C. — Today, Senator Ted Budd (R-NC) led a group of Senators to send a letter to Internal Revenue Service (IRS) Commissioner Danny Werfel demanding that the IRS open an investigation into the Palestine Chronicle’s tax-exempt status after Israeli hostages were rescued from the home of one of their reporters.

The letter was co-signed by Senators Rick Scott (R-FL), Ted Cruz (R-TX), Roger Wicker (R-MS), Joni Ernst (R-IA), and Pete Ricketts (R-NE).

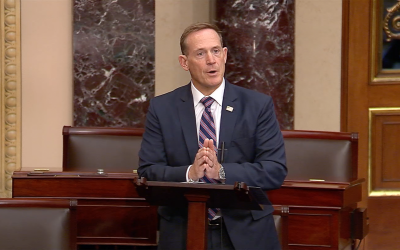

Senator Budd said in a statement:

“It is disturbing that a Hamas terrorist was reportedly holding Israeli hostages while masquerading as a journalist for the Washington-based Palestine Chronicle. Hamas is a foreign terrorist organization that has American blood on their hands and still holds Americans hostage. The potential link between this publication and Hamas terrorists should be more than enough justification for the IRS to open an investigation into their tax-exempt status in the United States. If the terrorism links are proven and substantiated, this status should be immediately revoked.”

On June 8, 2024, the Israeli Defense Forces, Shin Bet, and Yamam bravely rescued four Israeli hostages, including three from the home of Abdallah Aljamal, a correspondent for the Washington state-based Palestine Chronicle, a 501(c)3 non-profit organization.

As you know, the Department of State designated Hamas as a foreign terrorist organization on October 8, 1997. Reports over the weekend confirm Aljamal’s role in holding these hostages after the October 7th Hamas terrorist attack that killed more than 1,200, including 33 Americans, and took more than 240 hostages, including 12 Americans.

According to the Palestine Chronicle, Aljamal is a “well-known journalist” whose articles they published several times while he held these hostages in his home. He previously served as a spokesman for the Hamas-run Palestinian Ministry of Labor in Gaza. While Aljamal may have played a journalist by day, the evidence clearly suggests he was, at a minimum, a Hamas collaborator, if not a full-time terror operative, responsible for keeping hostages captive.

We are concerned that the Palestine Chronicle, an IRS tax-exempt organization, was actively employing an individual with apparent ties to and support for Hamas. It is possible that this tax-exempt media outlet had no knowledge of its correspondent’s Hamas affiliation; however, given the organization’s recent attempts to cover up evidence of its ties to Aljamal, this seems unlikely, making them complicit in supporting terrorist propaganda on their platform.

As previously noted by the Senate Finance Committee Chairman:

“established law has long held that an organization is not eligible for tax exemption under section 501(c)(3) if the purpose of the organization is contrary to public policy or is illegal. The IRS has established a three-part test to determine whether an organization’s activities are consistent with exemption under section 501(c)(3): (1) whether the purpose of the organization is charitable; (2) whether the activities are not illegal, contrary to a clearly defined and established public policy, or in conflict with express statutory restrictions; and (3) whether the activities are in furtherance of the organization’s exempt purpose and are reasonably related to the accomplishment of that purpose.

“Similarly, the IRS has held that illegal acts may disqualify an organization from tax-exempt status under section 501(c)(4). IRS regulations provide that an organization is operated exclusively for the promotion of social welfare if it is primarily engaged in promoting in some way the common good and general welfare of the people of the community. The IRS has held that “[i]llegal activities, which violate the minimum standards of acceptable conduct necessary to preserve an orderly society, are contrary to the common good and the general welfare of the people in a community.”

“[The] IRS has strictly enforced these holdings with respect to incitement of violence and terrorism. In Rev. Rul. 75-384, the IRS held that an antiwar protest organization that urged demonstrators to engage in civil unrest by committing violations of local ordinances and breaches of public order did not qualify as a tax-exempt entity under section 501(c)(4). Further, the IRS has established that the severity of violent and terrorist acts must be considered beyond the mere proportion that such acts constitute of an organization’s overall activities. In GCM 34631, the IRS stated even a small amount of violence or terrorism is sufficiently substantial to require revocation of exempt status:

To determine when disqualifying activities are present to a ‘significant extent’ (that is, when they become ‘substantial’), more must be considered than the ratio they bear to activities in furtherance of exempt purposes. The quality of such acts is as important as the quantity. A great many violations of local pollution regulations relating to a sizeable percentage of an organization’s operations would be required to disqualify it from 501(c)(3) exemption. Yet, if only .01% of its activities were directed to robbing banks, it would not be exempt. This is an example of an act having a substantial non-exempt quality, while lacking substantiality of amount. Very little planned violence or terrorism would constitute ‘substantial’ activities not in furtherance of exempt purposes.

“Not only are acts of terrorism or violence committed by an organization grounds for revocation of exempt status, but any 501(c)(3) organization that encourages, plans, or supports an illegal act may be subject to revocation. Further, the IRS has held that (1) acts conducted by organization officials under actual or purported authority to act for the organization, (2) acts by agents of the organization within their authority to act, or (3) acts ratified by the organization should be considered activities “of the organization.” While acts in excess of an officer’s authority will generally not be considered an act “of the organization,” if an organization allows such actions to go unchallenged, the IRS will consider the act to be ratified by the organization.

“IRS tax exemption represents an official government endorsement of an organization and its activities and bestows upon tax-exempt entities a significant financial benefit. Any organization that fails to provide for the public good, or worse — [is complicit in supporting violence, terrorism and hostage taking] — must not be allowed to remain in operation.”

Accordingly, we urge the IRS, in coordination with other law enforcement agencies, to investigate the extent of the Palestine Chronicle’s knowledge of Abdallah Aljamal’s connections to Hamas and publishing of his stories while he held hostages, and to the greatest extent of the law, revoke the tax-exempt status of this organization that employed an individual who committed these violent, illegal, and terrorist acts.

In addition, we ask that the IRS prepare a report on the findings of this investigation for the Finance Committee to review in the appropriate venue.

.###