Washington, D.C. — Today, Senators Ted Budd (R-NC) and Kirsten Gillibrand (D-NY) introduced the bipartisan Financial Technology Protection Act.

The legislation establishes the Independent Financial Technology Working Group to Combat Terrorism and Illicit Financing.

The bill has twice passed the House unanimously in 2018 and 2019.

In the House, the bill is led by Reps. Zach Nunn (R-IA) and Jim Himes (D-CT).

The legislative text of the bill is HERE.

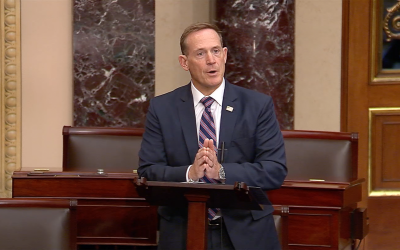

Sen. Budd said in a statement:

“New technological innovations have improved the lives of millions of Americans. Unfortunately, criminals and terrorists are increasingly able to use new financial technologies to wreak havoc on our fellow citizens. Our government needs to take this threat seriously, and that’s why this bill is so important. It takes meaningful strides to help stop the illicit use of new financial technologies.”

Sen. Gillibrand said:

“As innovation in traditional finance continues, we must ensure that our financial systems are equipped to combat the utilization of these new technologies to evade sanctions, finance terrorism, and launder money. The bipartisan Financial Technology Protection Act would establish an independent financial technology working group that would convene regulators, experts and industry stakeholders to identify and address risks in the rapidly evolving financial technology landscape and to develop innovative solutions to keep our financial systems secure. This bipartisan legislation has already passed the House twice, and I look forward to working with Senator Budd to pass this important bill in the Senate.”

Rep. Nunn said:

“Digital assets are quickly emerging as a major way in which we spend money – I want to ensure every American has access and privacy and that our country has protections. This bipartisan bill will help ensure the United States is prepared to address security risks and prevent illicit money laundering while also protecting freedom for all Americans. We must do both simultaneously to ensure the long-term integrity of digital assets.”

Rep. Himes said:

“The rapid evolution of our financial systems demands increased attention to reduce risk and combat abuse by terrorist organizations. As Ranking Member of the House Intelligence Committee, I am glad to support this working group which will unite senior members of the Intelligence Community with experts in financial innovation under the shared mission of tracking illicit financing by malicious actors.”

Background:

- The Financial Technology Protection Act establishes an independent working group to combat terrorism and illicit financing, composed of one senior representative from each of the following agencies:

- Department of the Treasury

- Department of Justice

- U.S. Secret Service

- Financial Crimes Enforcement Network

- Federal Bureau of Investigation

- Department of State

- Drug Enforcement Administration

- Internal Revenue Service

- Department of Homeland Security

- Office of Foreign Assets Control

- Central Intelligence Agency

- The working group must also have 5 representatives appointed by the Under Secretary for Terrorism and Financial Intelligence that represent financial technology companies, financial institutions, institutions or organizations engaged in research, and blockchain intelligence companies.

- The working group will conduct research and develop proposals to improve anti-money laundering and counter-terrorist financing efforts.

- The group will also submit annual reports on its findings and recommendations to Congress.

- The bill requires the President, through the Secretary of Treasury, to submit a report to Congress detailing the potential uses of digital assets by foreign actors to evade sanctions and finance terrorism, along with a strategy to mitigate and prevent their illicit use.

###